Risk Factor Attribution

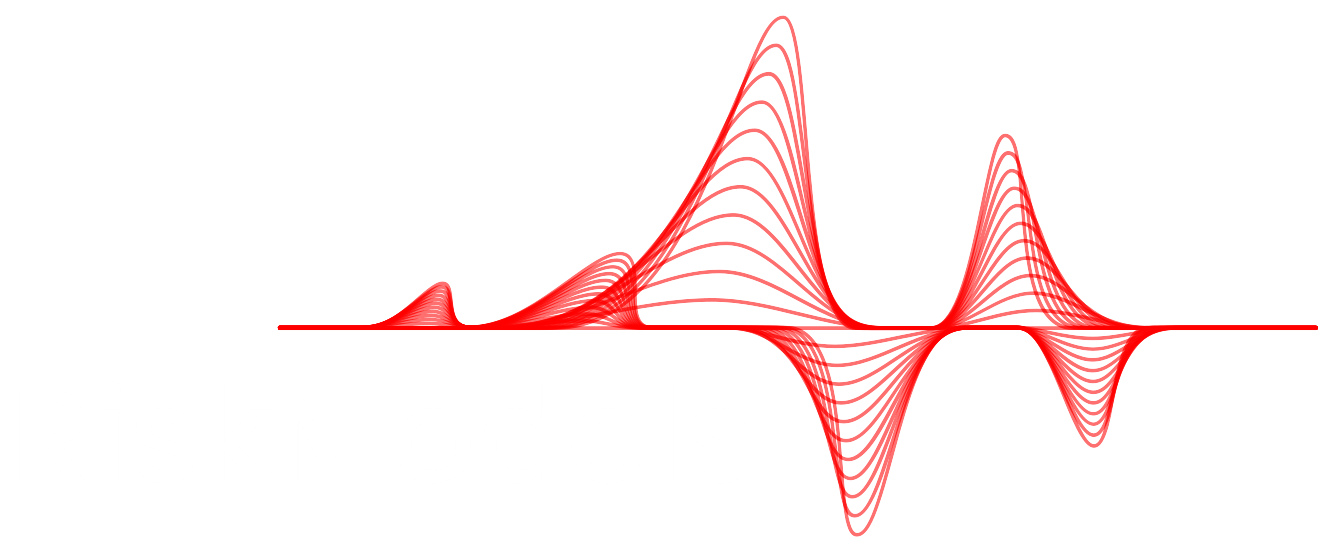

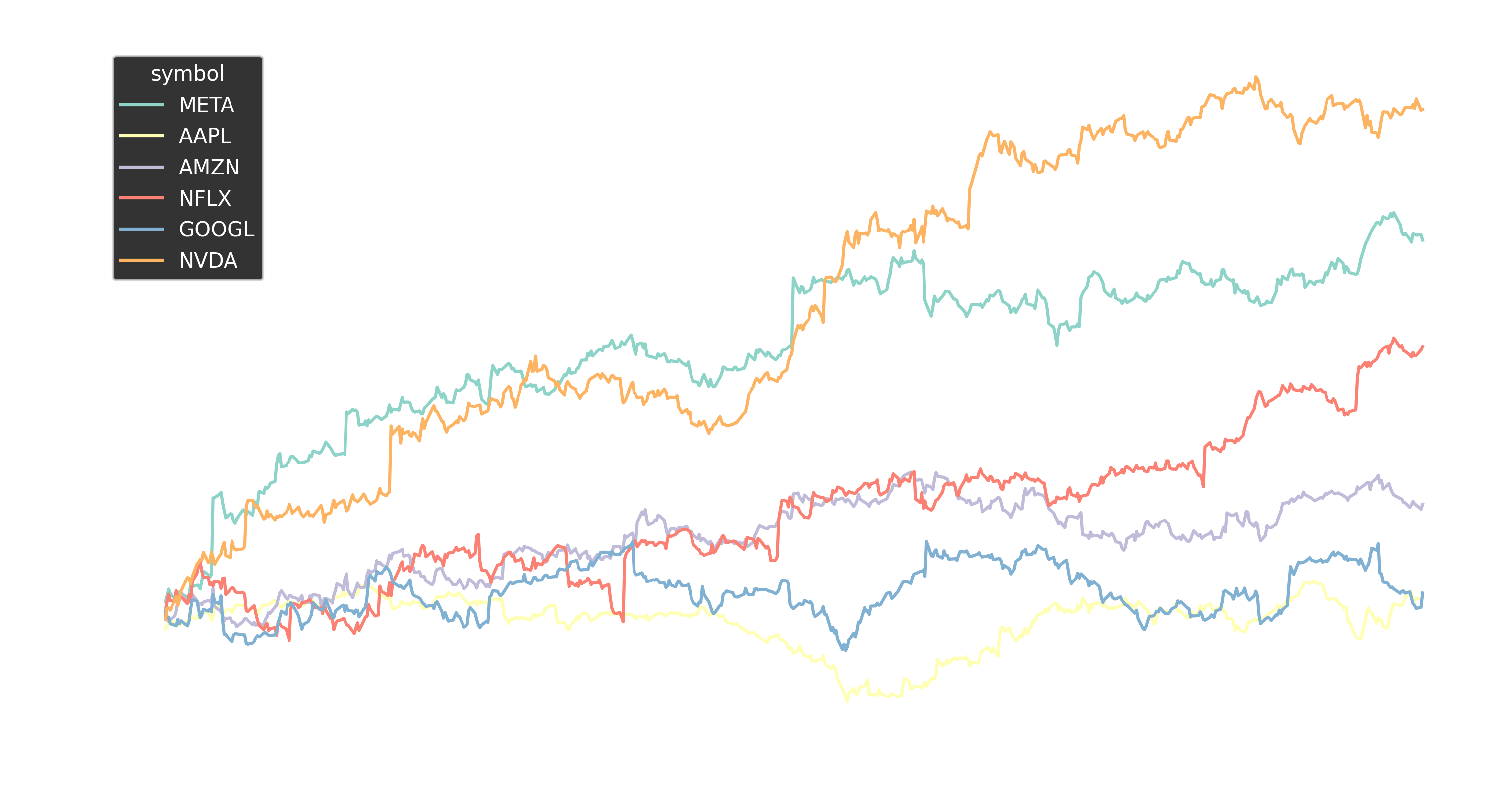

To assess each stock's sensitivity to movements in underlying factors—commonly referred to as beta—we run our proprietary regressions that evaluate exposures to market and other risk factors.

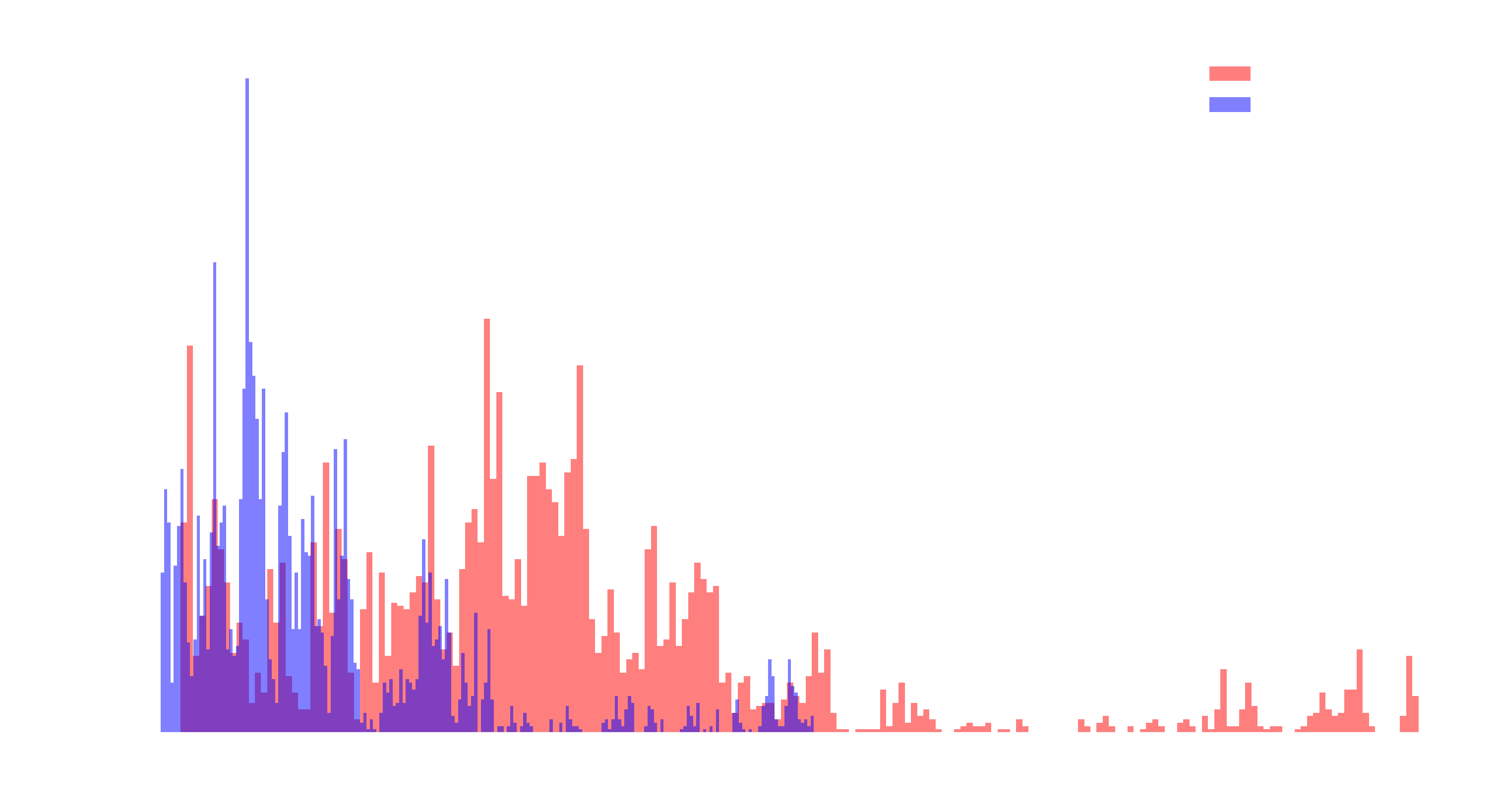

Variance Decomposition

Using factor exposures, we decompose risk along the following dimensions: 1. Market Risk - The portion of risk explained by the overall stock market. 2. Sector Risk - The portion of risk driven by sector-specific events. 3. Stock-Specific Risk - Unique risks not accounted for by market or sector movements.

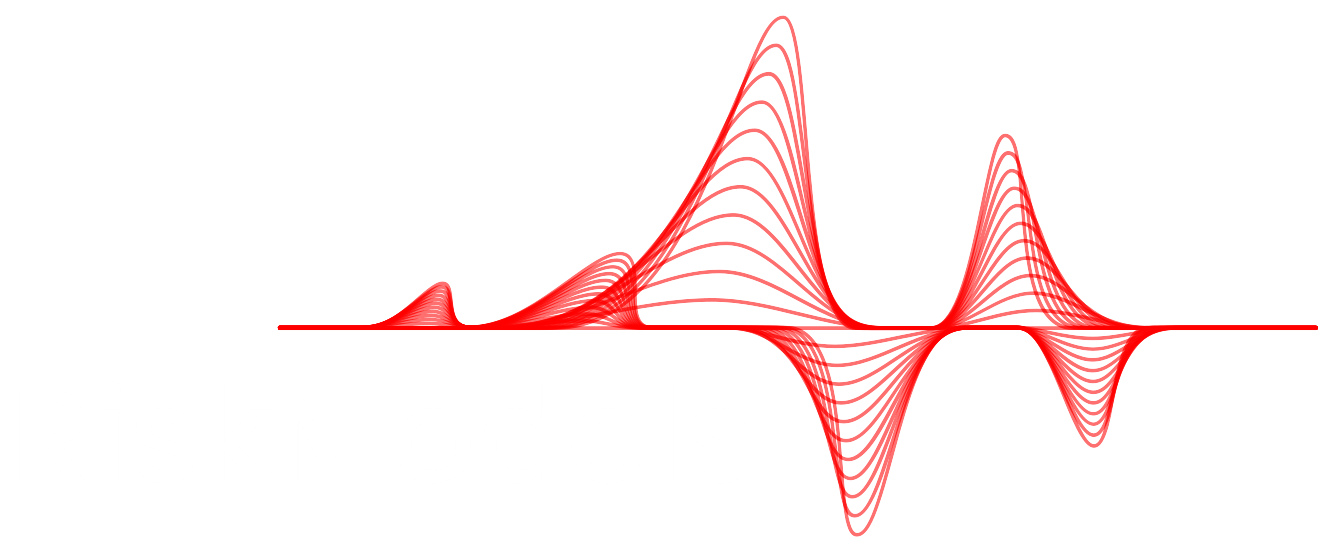

Forecast Horizon Control

Customize your forecast horizon by extending training windows for longer-term predictions, offering more accurate risk projections over time.